Fica tax calculation 2023

FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

How To Calculate Your Federal Income Tax Refund Tax Rates Org

Employers must withhold FICA taxes from employees wages pay employer FICA taxes and report both the employee and employer shares to the IRS.

. Beginning in 2023 the taxable maximum. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for. To calculate your employees FICA tax.

The SSA provides three forecasts for the wage base intermediate low and high cost and all predict an increase to 155100 in 2023. Please note that the self-employment tax is 124 for the Federal Insurance Contributions Act FICA portion and 29 for Medicare. Beginning in 2023 a 4 payroll tax rate on.

Prepare and e-File your. Social Security tax and Medicare tax. For 2023 the trustees estimate that the taxable wage base will be 155100 up 8100 from the current wage base of 147000.

In 2022 only the first 147000 of earnings are subject to the Social Security tax. How to Calculate FICA Tax. Over a decade of business plan writing experience spanning over 400 industries.

The SSA provides three forecasts for the wage base. A 09 Medicare tax may apply. The aforesaid FICA tax calculator is based on the simple formula of multiplying the gross pay by the Social Security and Medicare tax rates.

Valid receipt for 2016 tax preparation fees from a tax preparer other than HR Block must be presented prior to completion of initial tax office interview. CNBC reported that a recent congressional proposal. For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum.

For the 2019 tax year FICA tax rates are. The fica tax calculator exactly as you see it above is 100 free for you to use. You can calculate your FICA taxes by multiplying your gross wages by the current Social Security and Medicare tax rates.

The OASDI tax rate for wages paid in. FICA taxes are divided into two parts. For example Employer will deduct.

To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. Employee 3 has 37100 in eligible. This projection is based on current laws and.

To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145. This Tax Return and Refund Estimator is currently based on 2022 tax tables. May not be combined with other.

Social Securitys Old-Age Survivors and Disability Insurance OASDI program and Medicares Hospital Insurance HI program are financed primarily by employment taxes. Since the rates are the same. Lets say your wages for.

The FICA portion funds Social Security which provides. Both employees and employers pay FICA taxes at the same rate. The Social Security tax rate is 62.

Tax rates are set. It will be updated with 2023 tax year data as soon the data is available from the IRS. Increase the payroll tax rate to 161 up from the current 124 with no changes in the taxable income.

Ad Being an Industry Leader is Earned Not Given Business Planning Simplified. Lets say your wages for 2022 are 135000. Here are the provisions set to affect payroll taxes in 2023.

The current rate for. The FUTA tax liability is based on 17600 of employee earnings 4900 5700 7000. Social Security and Medicare Withholding Rates.

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

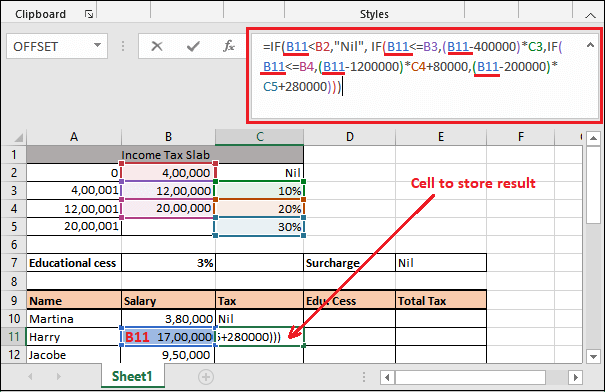

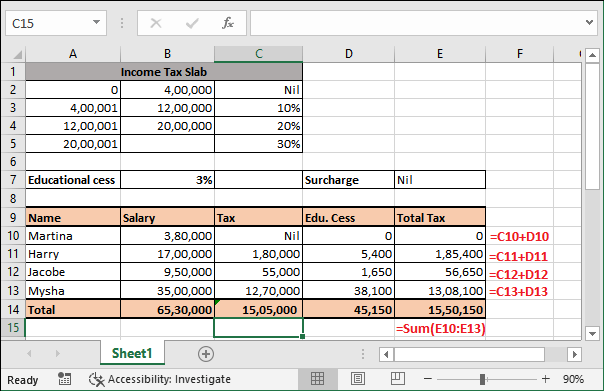

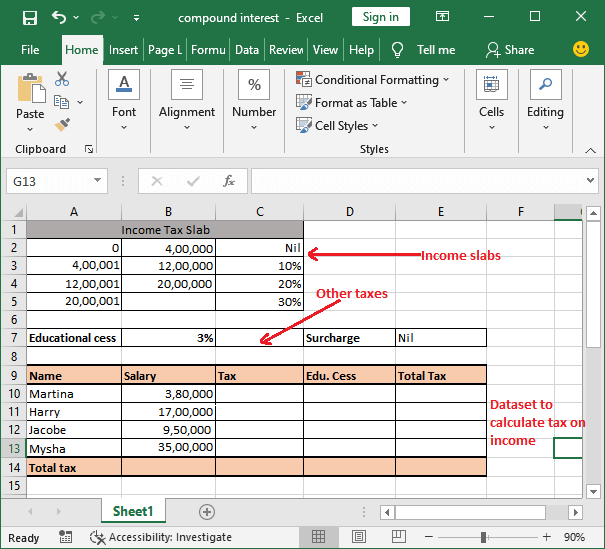

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Fica For 2022 Workest

Taxable Income Formula Examples How To Calculate Taxable Income

Corporate Tax Meaning Calculation Examples Planning

Estimated Income Tax Payments For 2022 And 2023 Pay Online

Capital Gain Tax Calculator 2022 2021

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Income Tax Calculating Formula In Excel Javatpoint

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

Income Tax Calculator Fy 2022 23 Excel Download Ay 2023 24 Youtube

Income Tax Calculating Formula In Excel Javatpoint

How Is Taxable Income Calculated How To Calculate Tax Liability

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Find The Right Way To Plan Your Taxes Forbes Advisor